Do you know the phone can make any of the purchases like your wallets do? Aside from all the convenient factors many of the practical reasons make the payments with mobile devices. The security of the mobile payments subways is the tools that provide security than the traditional cards, that are skimming and the data breaches. This diminishes the benefits of the PIN cards and the chip took over. This article will describe How to take card payments over the phone.

What are basic that needs?

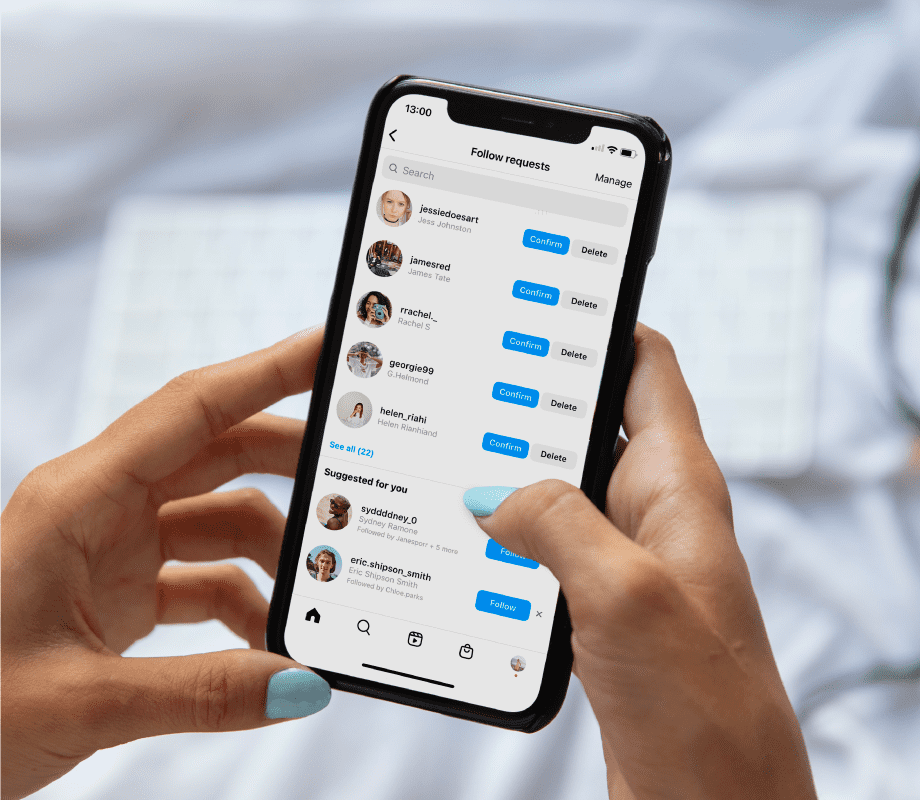

To make the payments that the customer needs the phone to the NFC [near field communication] capability to enable. The NFC makes your phone to communicate to the respected merchant’s payments and the terminals through the radio waves then the newer phone has the hardware NFC available. However, the customer does not available with the processing payments in an entire online with merchants. Check where the customer shops the most often then find out where the merchants require the compatible devices.

To spend the amount with the phone, then the customer must typically store the payment information in the wallet. To enter the credit card and debit card account information in the wallet. The bank account information link with the wallet to another payment account. Several popular wallets include apple pay, Samsung pay, and google pay.

Paying the merchants by the phone:

After the customer sets the mobile wallets on the device, the customer ready to make the payments, in most cases the customer goes to the cashier’s terminal. When the time comes to pay it is important to follow the merchant’s advice with the basic knowledge. The customer will hold the device near while the payment terminals that gently touch the phone. While completing the payments the customer will need to verify the identify the payments that happen. Many of the mobile payments will not ready by some merchants, this might pay with the credit card where the merchants do not look after the actual credit information.

It is safe by making the payments with mobile phones, mobile payments are safe, and using the card for the practice is the safes phase. The wallets that describe the payments with the credit cards will not see the actual information by the merchants. This means that the card numbers or the security code will never be disclosed by the merchants.

Challenges by mobile payments:

Mobile payments may make some of the situation to be worse. This might not mean to leave the house without the forms of the payments the retailer has not warmed up with those ideas, but the customer has to pay the old ideas from different times. The problem is the dead battery if we depend more on the technology then we will end up with totally vanished when we meet the failure. Whenever the customer has the mobile phone they can pay the amount by using it if not it is advisable to not get involved in such a kind that may worsen the situation and the customer may end up with a big loss with their money. These are the major points about mobile transactions.

Comments