Mutual funds have emerged as one of the most popular investment avenues among all types of investors. By regularly investing in mutual funds, you can gain inflation-beating returns and build a corpus for your long-term financial goals, such as your child’s education and your retirement.

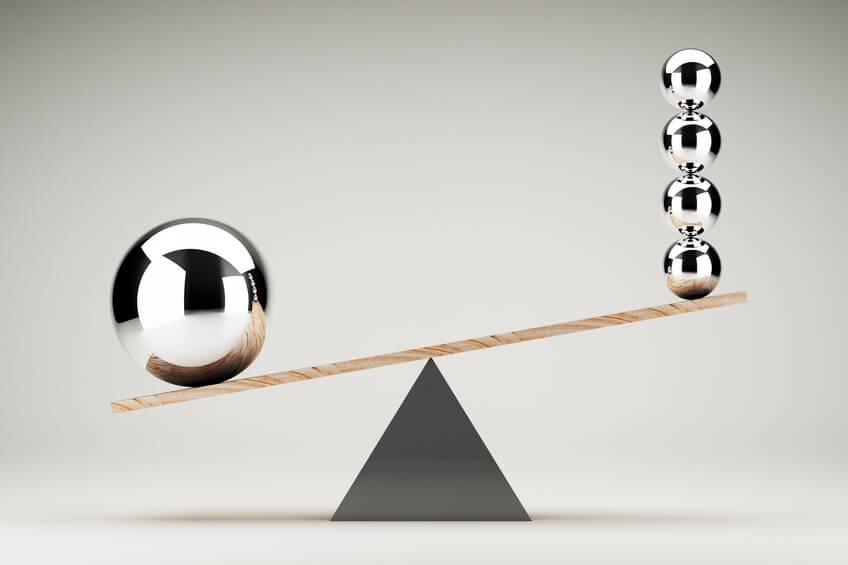

However, it’s crucial to get your asset allocation right and build a balanced mutual fund portfolio. And asset allocation isn’t something that you can set and forget. You need to rebalance your mutual fund portfolio from time to time to ensure that it aligns with your investment objectives and risk tolerance.

To invest in mutual funds, you can either visit the respective asset management company’s website or download the Moneyfy app on your smartphone.

What is the meaning of “Balancing a mutual fund portfolio”?

Balancing your mutual fund portfolio means choosing the right mix of investment assets in your portfolio so that it remains appropriate for your investment goals and risk profile.

The balancing of your portfolio can be done by buying and/selling all or some mutual funds in your portfolio to bring the asset allocation percentage back to the balance.

Why is balancing your portfolio important?

While investing in mutual funds, you get the option to invest in either equity funds or debt funds. While equity funds provide you with an opportunity to earn superior returns on your investment, they come with very high volatility. On the other hand, debt funds offer you more stability but at the cost of lower returns.

It is essential to understand your financial goals and risk appetite and do your asset allocation accordingly. For example, if you don’t mind taking high risks for gaining better returns, you can select a higher percentage of equity funds in your portfolio. Conversely, if you’re a risk-averse investor, you should opt for a higher percentage of debt funds.

Also, the financial goals and risk profile of a person keep changing from time to time. Young people with fewer responsibilities usually prefer to take greater risks for potentially high returns, whereas people approaching retirement generally refrain from making high-risk investments.

Balancing your investment portfolio at regular intervals allows you to ensure that it aligns with your specific profile. It also provides you with an opportunity to earn higher returns on your investment.

Who should balance your portfolio?

If you have adequate knowledge about the market, you can balance your mutual fund portfolio by yourself. You can buy or sell certain quantities of some or all mutual funds in your portfolio to achieve the right mix of equity-debt percentages. However, if you are not well-versed with market knowledge, you can hire an investment advisor to balance your portfolio on your behalf.

Conclusion

While balancing your mutual fund portfolio at regular intervals is vital, equally important is to diversify your investments. You can choose to invest simultaneously in many different avenues such as fixed deposits, bonds, and securities.

The Tata Capital Moneyfy app allows you to invest in various mutual funds seamlessly and fulfill all your financial needs in a hassle-free manner.

Comments